The U.S. Tire Manufacturers Association released our 16th End-of-Life Tire Management Report on October 24, 2024. This biannual report highlights the latest market insights, trends, and opportunities for advancing sustainable and circular end-use markets.

Our Vision for Sustainability in Tire Manufacturing

USTMA members share a common vision on sustainability which includes: Promoting tire safety; advancing worker safety; reducing greenhouse gas emissions throughout a tire’s useful life; improving environmental footprints over time; minimizing the health, and environmental impacts of tire materials; and ensuring end-of-life tires enter sustainable markets.

Specifically, USTMA members share the goal that all ELTs enter sustainable and circular end-use markets. Our 2023 End-of-Life Tire Market Summary Report measures our progress toward meeting our sustainability vision.

ELTs consumed by end-use markets

increase in overall utilization of ELTs

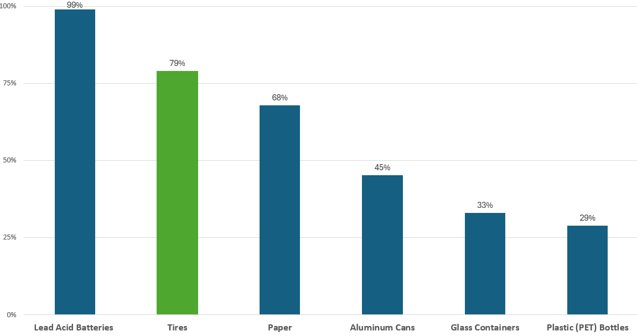

2023 End Use Rates for Common Materials

End-of-life tires remain one of the most recycled and reclaimed consumer products with 79% going to beneficial end use markets. ELTs are recycled and reclaimed more than metal, glass, aluminum, plastic, and paper.

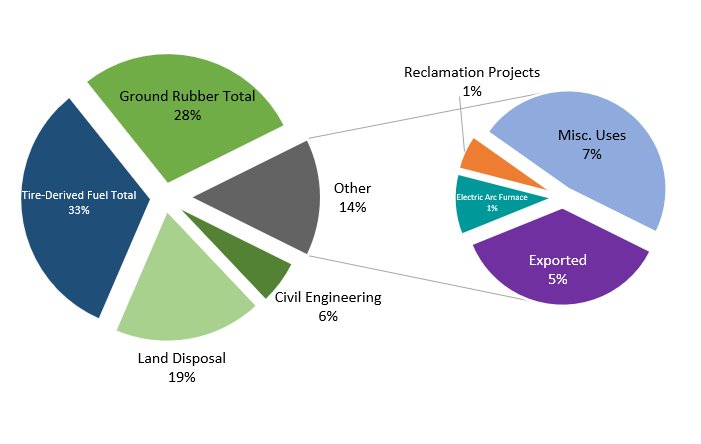

U.S. ELT Disposition 2023

Recycling end-of-life tires into ground rubber consumed about 28% of end-of-life tires. A large variety of smaller markets that were combined for this report consumed 14% of end-of-life tires. Moreover, the largest market for end-of-life tires returned to Tire Derived Fuel (TDF) in 2023 with a nearly 11% increase in the TDF market.

Rubber Modified Asphalt (RMA)

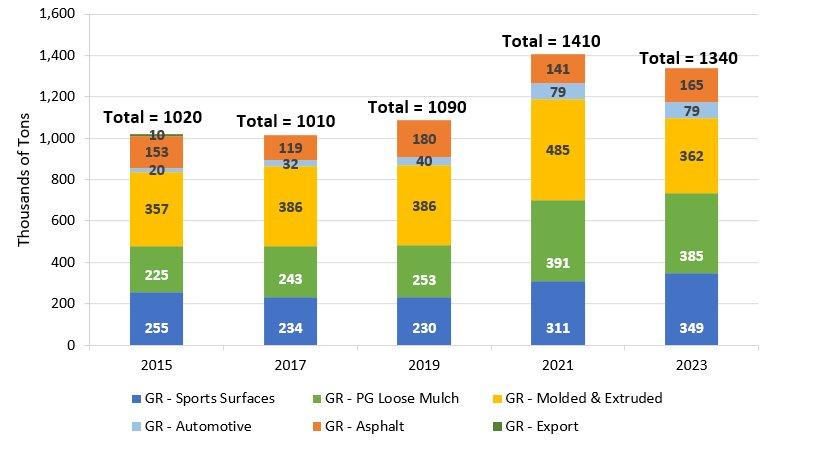

Since 2021, Rubber Modified Asphalt, a key use of ground rubber, has consumed 165,000 tons of ELTs, representing a 17% increase. This significant growth underscores RMA as a cost-effective, durable solution for U.S. infrastructure.

Frequently Asked Questions

Why does USTMA author and publish this report?

USTMA publishes this report every two years to track progress and encourage growth of reclaim and recycle markets. This is our 16th report and we’ve seen success – in the past 40 years, 95% of the 1 billion scrap tires that were sitting in stockpiles have been cleaned up, and tire reclamation and recycling has significantly increased since 2021. End-of-life tires remain one of the most recycled and reclaimed consumer products, outpacing materials including glass, aluminum, plastic and paper. But we need to do more to advance the circular tire economy. Given that the annual generation of end-of-life tires keeps increasing, there is the need for reclamation and recycling markets to keep up with this growth.

What is your methodology for this report?

USTMA collects and reviews data from all the states that have any kind of tire program data. We normalize it for consistency and convert it into weight. We also survey the major tire recyclers and incorporate their reports into the analysis. Finally, we review the trade press and interview industry experts and associations. Then we synthesize the data into the report you see today. We follow our consistent methodology, so the reports are comparable over the years.

Market data accounts for 97% of end-of-life tires. A small number of tires are not accounted for in the analysis because states and processors do not supply data on all tires. These tires are most likely landfilled.

What are the major updates in the ELT tire market between the 2021 and 2023 reports?

The USTMA’s latest End-of-Life Tire report found that tires remain one of the most recycled and reclaimed products in the U.S. In 2023, 79% of end-of-life tires (ELTs) were reclaimed or recycled, up from 71% in 2021 and 76% in 2019. However, tire recycling and reclamation markets are not keeping up with the annual generation of end-of-life tires. While substantial progress has been made to reverse negative trends, this report reveals that more needs to be done to advance the circular economy.

We must continue growing new and existing markets for ELTs. The Bipartisan Infrastructure Law will provide critical funding needed to expand sustainable infrastructure. But more work needs to be done to research environmental impacts of end-of-life tires, broaden state grant programs and expand the use of promising technologies. USTMA urges states and the federal government, industry groups, recyclers and environmental groups to work with us to expand use of rubber-modified asphalt, recycled rubber for industrial usage and new technologies like pyrolysis and electric arc furnaces.

What are tires recycled or reclaimed into?

End-of-life tires can be recycled into ground rubber for use in rubber-modified asphalt, the manufacturing of automotive and other industrial parts, tire-derived fuel and other products; tire derived aggregate is used for lightweight fill and vibration dampening in infiltration galleries that catch and purify stormwater.

What is the main use for end-of-life tires?

Tire-derived fuel, used by electric utilities and pulp and paper mills, is the largest reclaim and recycle market for ELTs (33%). More than a quarter (28%) of ELTs are reused in ground rubber markets and the use of ground rubber in asphalt increased 17% from 2021 to 2023. Sustainable infrastructure applications used 6% of ELTs.

What led to the increase in tire recycling and reclamation for 2023?

The report identifies the increased use of tire-derived fuels (TDF) as the primary driver of improved tire reclamation and recycling. TDF consumption saw an 11% growth rate between 2021 and 2023. This was primarily due to the increased costs of natural gas and other fossil fuels related to the war in Ukraine. TDF consumption by cement kilns increased by 15%, while paper mill and electric utility consumption increased by about 7% each.

There has also been a significant increase in the use of end-of-life tires for ground rubber, with the market growing by 29% since 2019. Ground rubber is used in a wide range of applications, including rubber-modified asphalt, athletic fields, automotive parts and industrial materials. The growth in this market follows the broader growth of sustainable materials across industries.

The report cites a 19% increase in tires going to landfills. Is USTMA concerned about this trend?

We are concerned about a 19% increase in tires going to landfills. USTMA remains committed to recycling 100% of all end-of-life tires and is working closely with state and federal agencies, the auto and recycling industries and environmental groups to reach that goal.

What markets will grow in the future and why?

We believe there is enormous potential – and need for – investments in sustainable infrastructure using reclaimed and recycled tires, including rubber-modified asphalt, industrial parts and civil engineering projects.

The rubber-modified asphalt (RMA) market grew 17% from 2021 to 2023. Asphalt is one of the most recycled materials and can be reused indefinitely. Studies to date show the benefits of adding ground rubber scrap tires to asphalt, including quieter pavement, better grip, less spray for drivers in wet weather and longer lasting roads that crack and rut less than traditional asphalt, leading to better long-term cost effectiveness.

Additional growth markets include the use of ground rubber in industrial applications. This includes automotive parts and industrial molds and extracts. While the report shows that this market declined by 22% between 2021 and 2023, it is possible the 2021 figures may have been overreported. These uses of ground rubber help reduce raw material extraction and contribute to a circular rubber economy.

The ground rubber sports surfaces market grew by 12% between 2021 and 2023. These surfaces in playgrounds and recreational facilities help make these public spaces safer and improve compliance with the Americans with Disabilities Act.

The use of tire-derived aggregate (TDA), or large shreds of scrap tires, in stormwater infiltration galleries also appears to provide significant benefits in reducing pollutants entering stormwater in urban areas. Galleries made with TDA reduce stormwater pollutants such as zinc and iron and stormwater galleries with tire chips reduce pollutants in stormwater runoff.

USTMA will release a TDA State of Knowledge report by the end of 2024.

How do new technologies like pyrolysis and electric arc furnaces contribute to the tire recycling market?

We believe that technologies like pyrolysis and electric arc furnaces show significant promise in helping to recycle critical tire components. Pyrolysis is used to create recycled carbon black, a silica used in tire production, and electric arc furnaces can recycle the steel used in new tires.

However, these technologies each currently account for less than one percent of tire reclamation and recycling, according to the data USTMA was able to attain. However, we believe that the true use of ELTs by electric arc furnaces is greater than indicated in the report and are working to close data gaps.

Both of these technologies could help significantly reduce the need for newly extracted or produced materials for tire production if backed by sufficient investment. USTMA continues to encourage both public and private investment in these and other new technologies that can help bring us closer to a circular tire market.

How do you know that using ground rubber from end-of-life tires is safe, given the dangers we’ve seen with crumb rubber in children’s playgrounds?

Safety is always our number one priority. To date, several scientific studies have not found a link between crumb rubber and health issues. USTMA supports continued research, and we are working with a wide range of government and academic researchers to ensure they have all the information they need.

What does USTMA want to happen in the future to enable sustainable markets for ELT management?

USTMA remains committed to recycling 100% of all end-of-life tires and is working closely with state and federal agencies, academic institutions and various stakeholders to reach that goal. New public and private sector investments are needed to create and expand circular ELT markets, research the lifecycle impacts of ELTs, and create a national portal for states, universities and other researchers to share data. State and federal policies should encourage the growth of reclamation and recycling markets including investments in rubber-modified asphalt, sustainable infrastructure projects and new technologies.

The Tire Recycling Foundation (TRF) is a joint initiative of USTMA and the Tire Industry Association. It aims to provide critical educational and research support for the entire ELT market.

What are the implications of the increase in end-of-life tire exports?

According to the 2023 report, ELT exports have almost tripled since 2021 and have increased by 83% from the previous 2019 high point. Many tire export markets, like Japan and South Korea, have reliable government regulation in place to ensure safe, productive reclamation and recycling of these ELTs.

However, a growing number of ELT exports are arriving in India, which does not have the necessary regulations in place to ensure safe storage or proper use. Some exports to India may also break U.S. federal laws. USTMA calls on all ELT exporters to ensure their destination markets are properly equipped to both safely reuse tires and protect the environment.

How are Extended Producer Responsibility (or take-back) programs affecting ELT management?

Extended producer responsibility programs are government-mandated programs that aim to achieve 100% recycling of a target product. While the tire industry shares this 100% reclamation and recycling goal, we have been working with state partners for over 30 years to develop uses for end-of-life tires. We believe that the current market system of industry and states working together to determine products for ELTs is cheaper, faster and more effective than a typical extended producer responsibility program.

What do states need to do around end-of-life tires?

In the last 40 years, states have made enormous progress in reducing ELT stockpiles, including the reduction of tire monofills. As we tackle the remaining 5% of stockpiled ELTs, states must sustain this progress by not shifting funds away from clean-up programs and enforcement efforts that propel the sustainable management of ELTs. There are currently just under 48 million ELTs remaining in stockpiles.

USTMA also supports reasonable fees on the sale of new tires to manage state programs, like those collected in 35 states. Without proper funding for state end-of-life tire programs, there is an increased risk to the progress made in tire recycling and reclaiming and environmental stewardship.

Which states are the top priorities for tire stockpile cleanup?

States with the largest number of end-of-life tires in piles include Colorado, New Jersey, New Mexico and Texas. All these states have active stockpile cleanup programs.

We support state programs with strong enforcement mechanisms to manage “bad actors” and require financial assurance for tire haulers and processors because they help to prevent illegal dumping and stockpiles. USTMA also supports reasonable tire fees to fund cleanup efforts.

USTMA's End-of-Life Tire Program

USTMA began its end-of-life tire program in 1990 under the auspices of the Scrap Tire Management Council. USTMA works with all stakeholders, including states, U.S. EPA and the industry to develop markets, reduce end-of-life tire (ELT) stockpiles and implement state regulations that that foster sustainable ELT tire markets. USTMA supports sustainable and circular ELT markets.

The Tire Recycling Foundation

Learn how USTMA & partners are working toward the goal of 100% of end-of-life tires entering sustainable and circular end-use markets.